EXECUTIVE SUMMARY

From Grid to Charger

From Grid to Charger

How the Electrical Contractor Can Win in the EV Space

- Driven by multiple factors, EV adoption is rapidly accelerating.

- The e-mobility market involves more than just the car.

- There are multiple aspects in creating the charging infrastructure.

- Opportunities for infrastructure and service providers are available now.

- ABB provides equipment supporting the electrification of the EV infrastructure.

An entire infrastructure is required to support EVs, including chargers, gear and components, and upgrades to the electric grid. In total, e-mobility is predicted to be a $100 billion market in the U.S. by 2030; this is a once-in-a-generation opportunity with enormous revenue potential for electrical contractors (ECs). EVs create additive revenue opportunities for ECs in both residential and commercial markets. Understanding where these revenue opportunities lie—now and in the future—as well as their funding sources can help savvy ECs win new business.

ABB understands the important considerations for grid-to-charger electrical distribution systems, charger types, power levels, equipment needs, and more. ABB offers world-class technology for a wide range of applications and installations in the EV market, helping ECs electrify the U.S. for EVs.

From Grid to Charger: How the Electrical Contractor Can Win in the EV Space

SPEAKER

Key Takeaways

BloombergNEF predicts that by 2033, about 50% of vehicles sold in North America will be electric.

Electric passenger cars are expected to comprise 30% of new sales in the U.S. by 2030.

Electric transit buses are predicted to comprise 50% of all new bus sales by 2030.

When considering the e-mobility market, it involves more than just the car.

When considering the e-mobility market, it involves more than just the car.

$60 billion

$17 billion

$24 billion

There are multiple aspects in creating the charging infrastructure.

Charger and gear electrical components to meet the requirements of one example application: DC High Power

Charger and gear electrical components to meet the requirements of one example application: DC High Power

(in panel)

Optional:

LV step-down transformer for lower voltage devices onsite

(in panel)

Optional:

LV step-down transformer for lower voltage devices onsite

3600A

total

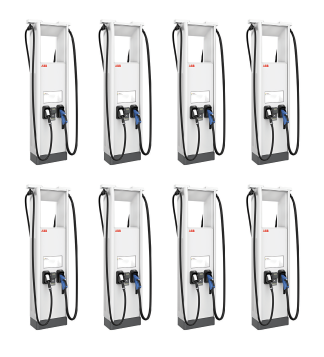

8x High Power DC chargers (175 kW)

2x High Power DC chargers (350 kW)

Upstream from the charger is the circuit breaker. Depending on the charger type, the upstream circuit breaker recommendation varies correspondingly, requiring a range of circuit breaker options as well.

On the services side, some end users opt for separate utility services for EV charging, whether to make it easier to meet grant funding requirements, to facilitate the addition of new servers and equipment rather than upgrade existing hardware, or to meet future bidirectional charging needs.

300A

600A

Opportunities in the EV market are available now and in the near future, for both infrastructure and service providers.

Large opportunities in the EV space exist now, such as building the electrical infrastructure for delivery fleets, charge point operators, convenience fuel stations, and charging integrators. Other opportunities coming soon include large rental fleets, hotel operators, commercial property managers, local fleets, multifamily dwellings, retail and shopping centers, and large parking decks. The government and utilities, as well as transit bus fleets and auto dealers, currently represent a significant opportunity for electrical contractors, with school bus fleets and airport operators close behind.

The National Electric Vehicle Infrastructure section of the Infrastructure Investment and Jobs Act provides a total of $5 billion over five years to all 50 states for EV investment (including chargers related equipment, and electrical installation). The law has defined a goal of creating a national public charging network with a minimum of four 150-kilowatt chargers every 50 miles along major highways. These opportunities do not only exist for the charger and gear for charging markets, but also for utilities.

Utilities also have significant EV opportunities, including four main areas of investment:

Utility rebates

State rebates

Volkswagen (VW) settlement funding

Additional Resources

Discover how the new line of ReliaGear smart power distribution products utilizes smart design and smart technology to simplify every level of protection for your project.